Yesterday, Democratic leaders in the Oregon House proposed a real plan to invest in our underfunded schools, grow Oregon’s economy, and protect low and middle income families. Naturally, big business and many Republicans are opposed — they appear to want to keep the unbalanced status quo, where we pay taxes and corporations don’t.

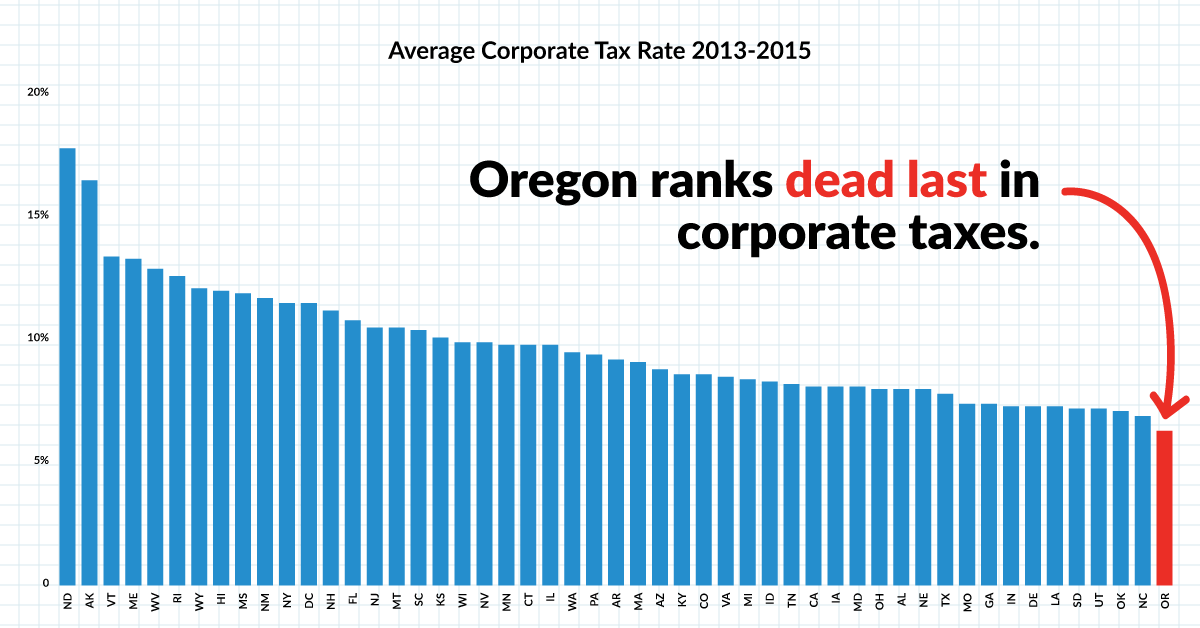

For years, Oregon has had the country’s lowest corporate taxes. The share of taxes paid by businesses is lower in Oregon than in almost every other state.1 Because big corporations pay so little in taxes here, we are constantly faced with inadequate resources for schools, infrastructure, and public services. Even with record low unemployment,2 this structural budget deficit exists. Taxpayers are doing everything they can, but their contribution without corporations doing their fair share simply isn’t enough to support the good schools we need.

The Oregon Education Investment Initiative proposed by Speaker Kotek and Chairs Barnhart and Nathanson will shift the burden of taxes from residents to corporate shareholders in other states. The plan raises taxes on large corporations while cutting taxes for low and middle income Oregonians. Naturally, big corporations will react to new taxes by trying to pass them along, by negotiating with suppliers for lower prices, for example. But it will be hard to pass the tax along in the form of higher prices. National firms use national pricing models that don’t depend on state taxes.3 If those firms do try to pass the tax onto consumers, nearly all of the cost will fall in other states; as a group, corporations that do more than $5 million in Oregon sales make 99.8% of their sales outside of the state.4

The reality is, most of the tax will be paid by the shareholders of big corporations — shifting Oregon’s tax burden to states around the country rather than our own backyard. Around 80% of the tax would be paid by corporations headquartered outside of Oregon.5 The wealthiest 1% in America owns most of the corporate stock,6 so they’ll be the ones paying most of this tax for Oregon’s schools. Only a small number of those millionaires live in Oregon7 — nearly all the tax will land outside the state.

In addition to making shareholders pay, the Oregon Education Investment Initiative will also make the federal government a large part of this new tax. Because the new state taxes are a deductible business expense off federal taxes, the large corporations that are taxed under this plan will simply deduct the state tax they pay off of their federal taxes.8 The higher the federal tax bill, the more businesses save — so certain industries that pay higher effective federal taxes, like retailers and wholesalers,9 will get the biggest tax breaks.

The Oregon Education Investment Initiative also includes tax cuts for low and middle income households. This is appropriate, Oregon should prioritize lowering the tax bill for Oregon families in exchange for increasing taxes on larger corporations. This will have an immediate positive impact on household bottom lines. But Oregon families will save in other ways too. Right now, families shell out hundreds of dollars for supplies because schools don’t have the resources to buy pencils and paper, or to pay for art, music, and sports. When schools have the funding they need, families will pay less.

If real revenue reform doesn’t pass, Oregon will see the budget deficit continue to grow.10 Right now the state has record low unemployment — basically as good as it gets. When the economy contracts (which it always does), personal income tax revenues will drop and the need for safety net assistance will rise. While revenues decline, the demands of a growing, aging population will continue to increase. Oregon will be unable to provide for schools, health care, senior services, public safety, and other critical state services without additional revenue. The time for action is now — Oregon can’t wait any longer.

1. http://www.andersoneconomicgroup.com/Publications/StateBusinessTaxRankings.aspx

2. http://www.oregonlive.com/business/index.ssf/2017/03/oregon_unemployment_rate_febru.html

3. http://oregonconsumerleague.org/wp-content/uploads/Side-by-Side-Shopping-Cart-Study.pdf

4. Calculation based on FY2014 corporate tax data from Oregon Department of Revenue

5. Calculation based on FY2014 corporate tax data from Oregon Department of Revenue

6. https://www.federalreserve.gov/pubs/feds/2009/200913/200913pap.pdf

7. http://phoenixmi.com/wp-content/uploads/2015/01/Phoenix-GWM-Millionaires-By-State-Ranking-2010-2014.pdf

8. https://www.irs.gov/publications/p535/ch05.html

9. https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/Average-Effective-Tax-Rates-2016.pdf

10. https://olis.leg.state.or.us/liz/2017R1/Downloads/CommitteeMeetingDocument/124928