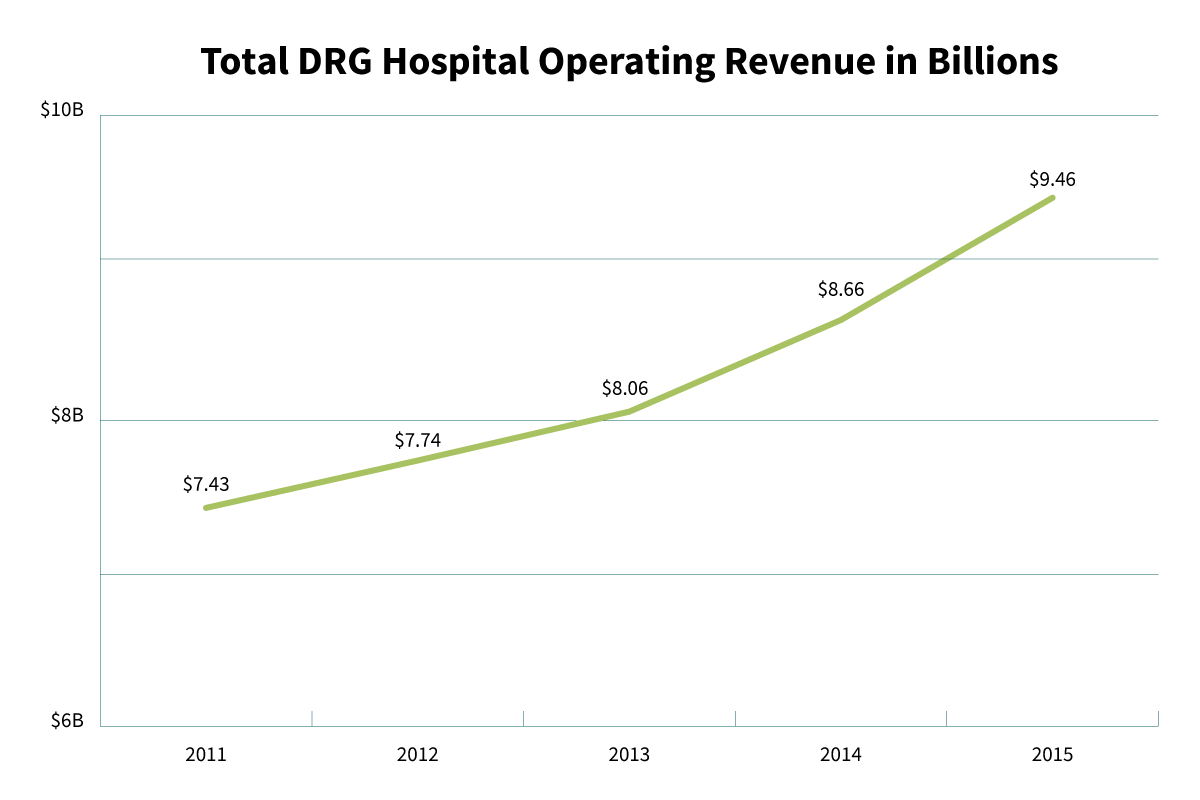

The health care industry is booming in Oregon. Our state’s fast-growing and fast-aging population means a greater demand for medical care than ever before, and the Affordable Care Act has reduced bad debt and boosted providers’ profits. In 2014 alone, the number of uninsured Oregonians dropped by 100,000.

It goes without saying that these changes have been good for business. Income for nonprofit hospitals has skyrocketed — in 2015, Oregon’s nonprofit hospitals saw their net income rise to over $1 billion, a 54% increase over the year before. What’s more, 58 of Oregon’s 60 hospitals are nonprofits, so they already don’t have to pay income taxes or property taxes, saving them tens of millions of dollars a year.

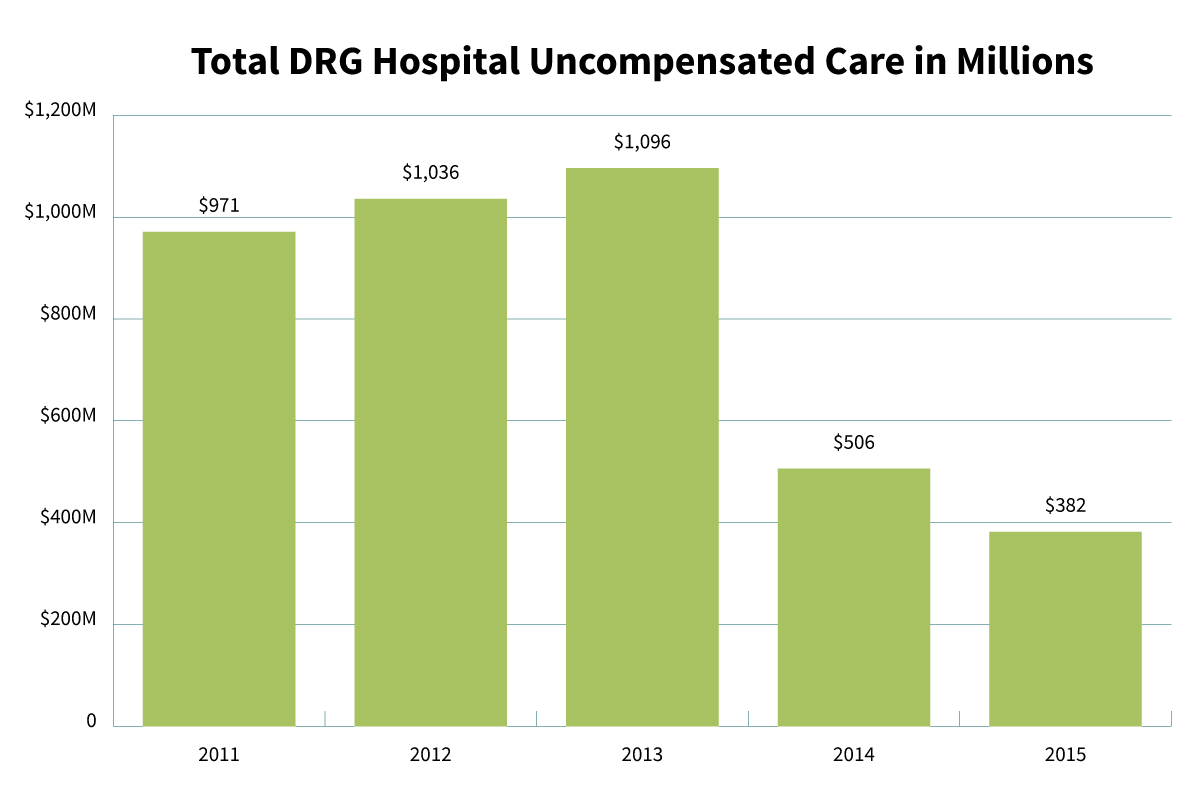

Here’s the problem: Giving tax breaks to nonprofit hospitals doesn’t work when they act like for-profit hospitals. In fact, profits are up, in part because hospitals are providing less charity care than they used to. Between 2013 and 2015, inflation-adjusted charity care at Oregon hospitals declined by 62%, saving hospitals around $545M in 2015 alone. By 2015, just 62% of Oregon’s nonprofit hospitals and their health systems accumulated over $5.9 billion in unrestricted cash.1

And the decline in charity care isn’t the only way nonprofit hospitals look a lot like they’re for profit. Medical debt is the leading cause of personal bankruptcy in America, and nonprofits aggressively pursue debtors even though the hospitals are very profitable and have large cash reserves. A study of personal bankruptcies in Lane County found 72% had medical debt, with a nonprofit hospital holding the most debt. That’s why other states, like Washington, still hold nonprofit hospitals accountable for their fair share.

So where is that $5.9 billion blank check going if not to charity care or debt forgiveness? As it turns out, nonprofit hospitals are an awful lot like big corporations. Just like Wells Fargo and Comcast, nonprofit hospitals pay outrageous salaries to their CEOs. Salaries in the health care industry are some of the highest in Oregon. Dr. George Brown, CEO of Legacy Health System, was compensated nearly $2 million in 2015. PeaceHealth’s CEO was paid $1.5 million in 2014. Dr. Monica Wehby, failed senate candidate, was paid $901,979 by Legacy Emanuel in 2014.

To sum it up: “Nonprofit” hospitals in Oregon are bringing in record profits, paying almost no taxes, providing fewer services to needy families, and paying their CEOs outlandish salaries — all at taxpayer expense. Today, 350,000 Oregonians are on the brink of losing access to to health care thanks to a $1.6 billion hole in the budget. It’s time for the health care industry to stop paying CEOs millions, and start paying their fair share.

1. Creditscope. Data are not readily available for all Oregon hospitals. This figure includes only hospitals and health systems for which Creditscope data was available. Although more Oregon hospitals were covered in 2011, only hospitals that reported in 2015 were included in order to create a legitimate comparison. This figure includes unrestricted cash from out-of-state systems with operations in OR adjusted based on the proportion of total NPSR generated in OR in that year. For instance, Providence generated ~23% of its NPSR in OR, so we assume 23% of its reserves were generated in OR. Kaiser is not included in this analysis since NPSR for their hospitals is unavailable.